Frequently Asked Questions

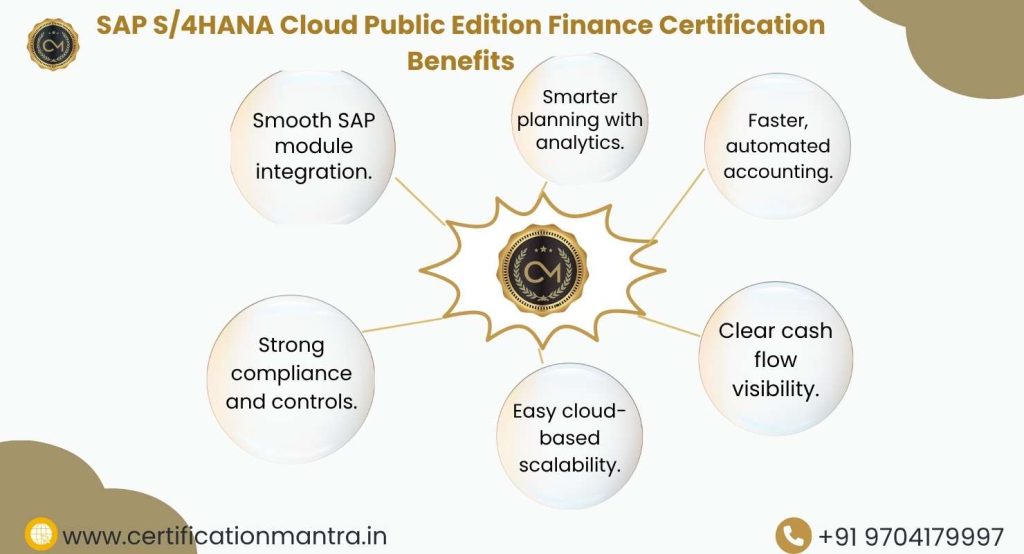

- SAP S/4HANA Cloud, Public Edition – Finance offers a modern, cloud-powered platform for managing financial operations.”. It helps companies manage accounting, reporting, and financial operations efficiently. The system uses real-time analytics for faster decision-making.

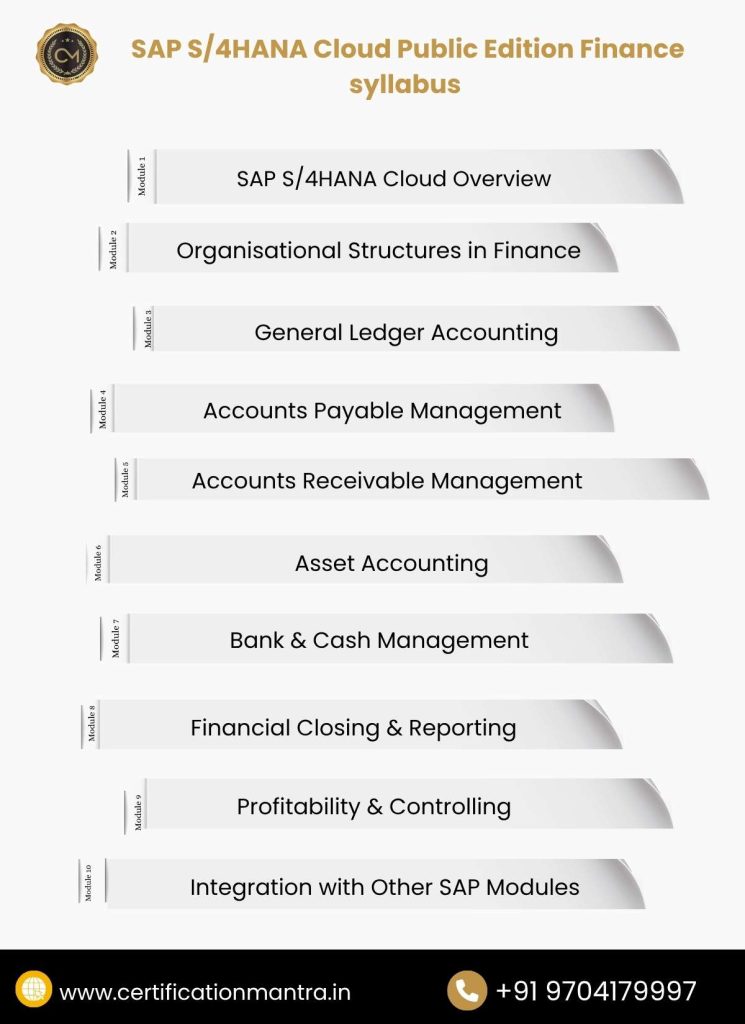

- It validates your skills in using SAP’s cloud finance modules and performing essential financial tasks. You learn how to manage G/L, AP, AR, Asset Accounting, and financial close. The certification proves your capability to work in SAP finance environments.

- Yes, beginners with finance or accounting knowledge can start. The training simplifies cloud finance concepts and system navigation. Even those switching careers can benefit from it.

- Preparation time varies from four to eight weeks, depending on your background. Regular practice and structured training speed up the process. Hands-on exercises help you learn faster.

- Most training programs include cloud practice systems. These labs help you understand real-world finance scenarios inside SAP. Practical exposure improves your confidence for the certification exam.

- No coding skills are required for SAP S/4HANA Cloud, Public Edition – Finance. The system is more configuration-based than development-based. Finance knowledge is more important here.

- You can apply for SAP Finance Consultant, SAP End-User, Accounts Executive, or Support Analyst roles. Companies hiring SAP consultants priorities certified professionals. This certification adds strong value to your profile.

- The exam difficulty depends on your preparation and practice. With proper training and hands-on exposure, most learners pass comfortably. Understanding business processes is key.

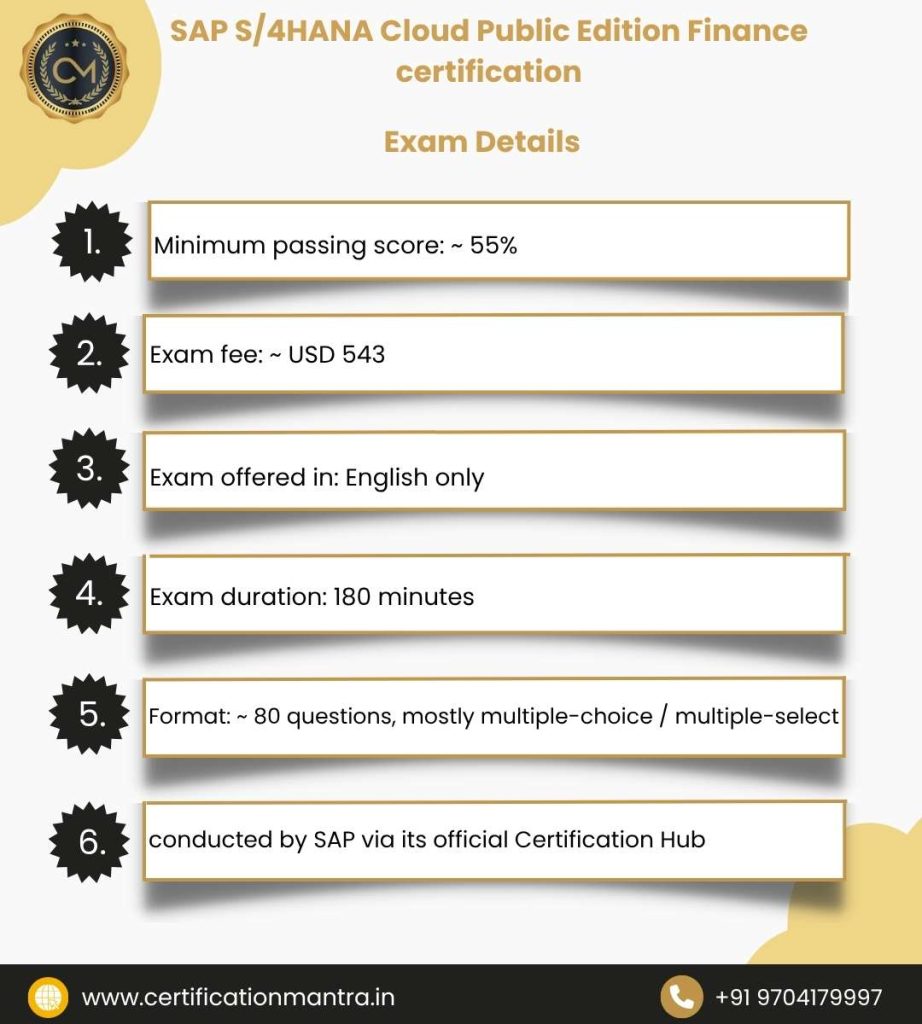

- The exam typically includes around 80 questions. These questions cover finance processes, configurations, and scenario-based situations. Time management is important during the test.

- The format is online and proctored. You answer multiple-choice and scenario-based questions. The test must be completed within the designated time.

- Yes, demand is rising as companies shift to modern cloud ERP systems. Finance professionals with SAP skills are highly valued. This certification improves your job market visibility.

- All industries, such as manufacturing, retail, IT, and services, use SAP Finance. The module supports universal financial processes across sectors. This makes your skills relevant globally.

- Yes, you can learn without prior SAP exposure. The training covers basics and moves step-by-step into advanced topics. Beginners can follow easily with consistent practice.

- It covers G/L Accounting, AP, AR, Asset Accounting, Bank Management, and Closing Operations. You learn how to execute transactions and generate financial reports. The module offers end-to-end finance coverage.

- Basic finance or accounting knowledge helps, but is not mandatory. A willingness to learn cloud systems makes the journey easier. Training provides all the necessary foundational topics.

- Yes, certified professionals often earn higher packages. Employers value validated SAP finance skills. “It enhances your professional profile and helps you stand out in a highly competitive job market.”

- You can choose online, classroom, or blended training formats. Each mode provides access to study materials and practical labs. Select the one that suits your schedule.

- You practice on SAP S/4HANA Cloud systems with guided exercises. Tools like SAP Fiori apps help you understand finance workflows. These tools prepare you for real-time SAP projects.

- Yes, the certification is recognised worldwide. SAP is a global leader in enterprise technology. Your credentials remain valid across industries and countries.

- The passing score is typically around 60–65%. It may vary based on the exam version. Always check the latest exam guide before attempting.

- You can attempt the same release up to three times. Each attempt requires booking a new exam slot. If you fail three times, you must wait for the next release.

- Many institutes offer placement assistance. They help with interview preparation, resume building, and job referrals. Certification adds strong value to your job applications.

- Yes, cloud finance offers faster updates and standard processes. On-premise systems provide deeper customization but require more maintenance. Cloud is more flexible for modern businesses.

- You learn financial postings, reporting, configuration basics, and Fiori-based navigation. These skills help you handle day-to-day finance operations. You also gain expertise in cloud-based finance workflows.

- Yes, certified candidates have a higher chance of selection. Certification proves both knowledge and commitment. It gives confidence to employers during hiring.

- Yes, most training programs start from the basics. Trainers guide you through each topic with simple examples. Even non-technical learners can understand easily.

- You receive modules, topic-wise notes, practice questions, and case studies. Hands-on tasks and assignments are also included. These materials support effective exam preparation.

- Absolutely, many learners shift from accounting or BPO to SAP roles. The certification strengthens your profile for SAP finance careers. It opens doors to consulting and implementation projects.

- It improves financial accuracy, speeds up reporting, and ensures real-time visibility. Businesses can make faster decisions using clean financial insights. This increases efficiency and profitability.

- Hyderabad is a major hub for SAP training and job opportunities. The city offers skilled trainers, a strong tech ecosystem, and placement support. Training here helps you start a stable SAP finance career.